What Happens if You Die Without a Will or Trust in Massachusetts?

Because confronting and thinking about death and dying is uncomfortable and unpleasant, many people avoid consulting an estate planning attorney to set up a Will or Trust.

However, if you die without a Will or Trust, the Massachusetts intestacy laws will determine who gets your property, not you. Dying without a Will or Trust often leads to unintended, expensive, and disastrous consequences.

One of the best reasons to set up a Will or Trust is to prevent conflict among your family after you die. Unfortunately, disagreements over estates have been known to tear families apart. Having a solid estate plan in place that clearly documents your wishes often eliminates family disputes after you die.

What is the difference between a Will and a Trust?

A Will is a legal document that distributes your property after you die. This property may include items of monetary or personal value, such as bank accounts, jewelry, furniture, or family heirlooms. A Will also appoints a guardian for minor children, directs payment of funeral expenses and other debts, and transfers real estate.

Similar to a Will, a Revocable Living Trust provides for the management and distribution of assets following your passing. But one advantage of a Trust over a Will is that a Trust allows your loved ones to avoid the probate process with regard to the distribution of your property. Probate is lengthy, public, and expensive. Often, your assets will be tied up for a year or longer before they can be accessed by your loved ones. Fortunately, assets held in trust generally do not become a part of the probate process. A Revocable Living Trust also allows for a smooth transition of control in the event that you become incapacitated and cannot manage your financial affairs. A Trust is a flexible document that can be changed to adapt to your unique life circumstances as time goes on. In addition, Trusts can help you to

shelter assets from the Massachusetts estate tax.

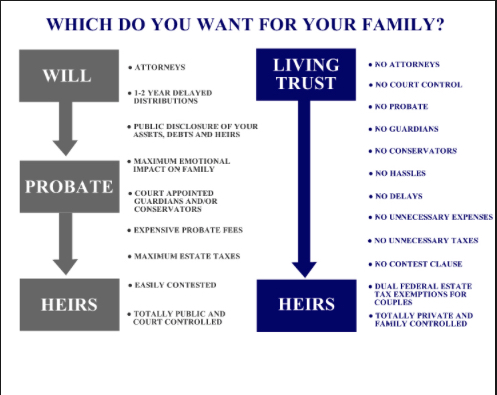

This graphic illustrates some of the important advantages a Trust offers:

Talk to a Legal Professional

At Morisi & Oatway we strive to make the estate planning process easy and comfortable for you. We start with an initial consultation that is free of charge where we spend time getting to know you so that we can recommend an estate plan that fits your specific needs, whether that be a Will or a Revocable Living Trust.

To learn more or schedule a free consultation with our lead Estate Planning Attorney Catherine Lundregan Oatway call (617) 479-0400 or email cso@morisi.com today.

Contact our office today at 617-479-0400 to discuss your business needs with one of our experienced lawyers.